See Our Latest Blogs

Lorem ipsum dolor sit amet, consectetur

Understanding How Canadian Personal Taxes Work

Understanding How Canadian Personal Taxes Work

A Guide with Case Studies for T4, T4A, and Self-Employed Individuals

Taxes in Canada can be confusing, especially when your income comes from different sources like employment (T4), independent contracts (T4A), or your own business (self-employment). Whether you’re a salaried worker, a gig economy hustler, or a full-time entrepreneur, the way you report and pay taxes varies significantly.

In this reading, we’ll break down:

How personal taxes work in Canada

The role of income sources (T4, T4A, Self-Employment)

Deductions, credits, and filing requirements

Case studies for three different types of individuals

A detailed comparison of how taxes apply to each

📌 How Canadian Personal Income Tax Works

Canada has a progressive tax system, meaning the more you earn, the more tax you payas a percentage of your income federal government province or territorywhere you reside.

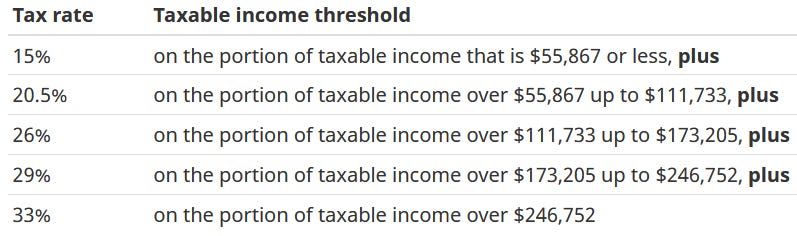

2024 Federal Tax Brackets:

2024 Provincial Tax Brackets (Ontario)

Each province/territoryhas its own tax brackets added on top of the federal rates.

🔍 Key Tax Forms:

T4: Issued by an employer showing employment income and deductions

T4A: Shows income from pensions, self-employment, commissions, or other sources

T2125: Statement of Business or Professional Activities (for self-employed individuals)

✨ Common Tax Deductions & Credits:

CPP and EI contributions (mandatory for T4)

RRSP contributions

Childcare expenses

Union dues or professional fees

Medical expenses

Canada Workers Benefit (CWB)

Home office expenses (for self-employed or remote workers)

GST/HST rebates (self-employed)

👤 Case Study 1: Sarah – Full-Time Employee with T4 Income

Profile:

Age: 32

Location: Mississauga, ON

Occupation: HR Specialist

Annual Salary: $70,000

Income Source: Only T4

Deductions: CPP, EI, RRSP ($5,000), union dues

How Her Taxes Work:

Her employer withholds tax, CPP, and EI automatically from her paycheque.

At year-end, she gets a T4 from her employer.

Sarah files a simple personal tax return (T1 General).

She claims her RRSP contributions and union dues.

She also qualifies for the Basic Personal Amount (federal ~$15,000 and Ontario ~$11,865 in 2025).

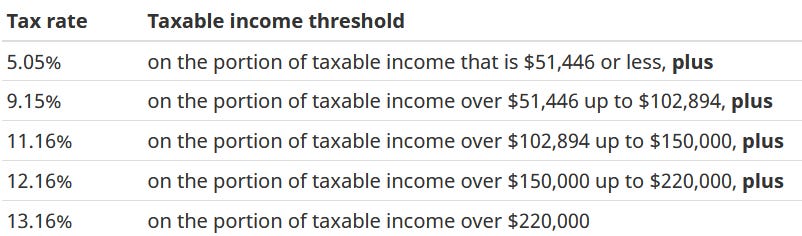

Tax Summary (Approximate):

Key Takeaways:

Simple and straightforward tax situation

Employer handles withholdings and remittances

RRSP helps reduce taxable income

Likely to get a refund or break even

👤 Case Study 2: Daniel – T4 + T4A Income

Profile:

Age: 40

Location: Calgary, AB

Occupation: IT Analyst + Freelance App Developer

Annual T4 Income: $85,000 (from full-time job)

Annual T4A Income: $25,000 (from side gigs)

Total Income: $110,000

Deductions: CPP/EI on T4, expenses from freelance work, RRSP ($7,000), home office, internet

How His Taxes Work:

Daniel receives both aT4 and a T4A.

TheT4A does NOT have any tax withheld, so he isresponsible for paying the taxon that income.

He completes aT2125 (Statement of Business Activities)for his T4A income to deduct business-related expenses.

He is required to payboth employer and employee portions of CPPon the net self-employment income.

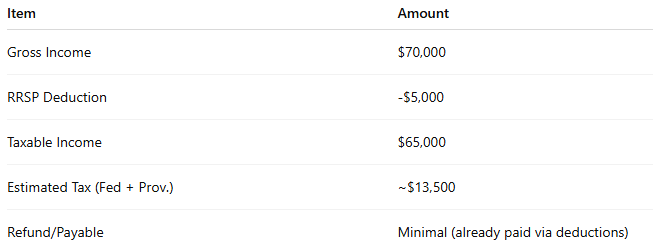

Tax Summary (Approximate):

Key Takeaways:

More complex filingwith both T4 and self-employment income

Needs to budget for taxes not withheld on T4A

Candeduct legitimate business expensesto reduce net income

Pays extra CPPas both “employer” and “employee” for side hustle

May want tomake quarterly tax instalments

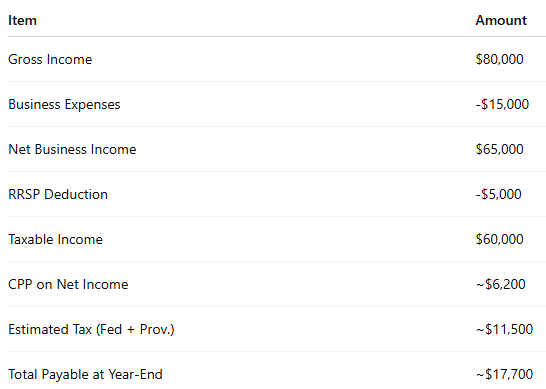

👤 Case Study 3: Nina – Fully Self-Employed (No T4 or T4A)

Profile:

Age: 36

Location: Halifax, NS

Occupation: Freelance Copywriter & Course Creator

Annual Gross Income: $80,000

Income Source: Self-employed (direct clients, course sales, no T4A issued)

Business Expenses: $15,000

Net Income: $65,000

Deductions: Home office, internet, RRSP ($5,000)

How Her Taxes Work:

Nina doesn’t receive any tax slips. Shetracks her income and expensesindependently.

FilesT2125to report self-employment income.

Must payboth parts of CPP (~10.9%)on net income.

No EI unless voluntarily enrolled.

Musttrack and remit GST/HSTif she crosses the $30,000 threshold.

May be eligible forCanada Workers Benefit (CWB)or business-use-of-home deduction.

Tax Summary (Approximate):

Key Takeaways:

Most tax and legal responsibilities fall on her

Needs goodbookkeeping and cash flow management

Responsible forCPP contributions, GST/HST, and year-end tax bill

Can claima wide range of business-related deductions

Strong candidate foreventual incorporationif income increases

💡 Comparing All Three Individuals

✅ Tips for Each Type of Taxpayer

For T4 Earners:

Maximize your RRSP and claim all available credits.

Use online tools likeSimpleTax or TurboTaxto file.

Considerincreasing source deductionsif you often owe taxes.

For T4 + T4A Earners:

Set aside 25–30% of T4A income for taxes.

Track all business-related expenses (home office, phone, subscriptions).

File yourT2125 accurately.

Consult an accountant aboutquarterly instalmentsif income is consistent.

For Self-Employed Individuals:

Open a separatebusiness bank accountand use cloud-based bookkeeping (like QuickBooks or Wave).

Keep all receipts and invoices.

Set aside 30–35% of income for taxes and CPP.

Register forGST/HSTonce you cross the $30K threshold.

Consider incorporation once your net income exceeds $80K–$100K/year consistently.

✍️ Conclusion

Understanding how Canadian personal taxes work is critical no matter what kind of income you earn. While salaried employees have a simpler process, individuals who receive T4A or are fully self-employed carry more responsibility—but also enjoy more opportunities for tax deductions and planning.

As the gig economy grows and more people operate side hustles or full-time businesses, being proactive about taxes is not just good practice—it’s essential.

Whether you’re like Sarah, Daniel, or Nina, make sure you:

Understand your income types

Track your deductions

Pay attention to CPP/EI obligations

File accurately and on time

Work with a tax professional if needed