See Our Latest Blogs

Lorem ipsum dolor sit amet, consectetur

New to Canada? Here’s How to Save Big on Your First Car Purchase 🚗

From Phone Plans to Car Deals — Save Thousands in Your First Year

Buying your first car in Canada is exciting — it means freedom, flexibility, and the chance to explore your new home on your own terms. But it can also be expensive if you’re not careful. Dealerships often add a long list of fees and extras to your bill — many of which you don’t actually need.

If you’re a new immigrant trying to get the best deal without being taken advantage of, this guide is for you.

🎯 Step 1: Choose the Right Type of Car

🛑 Don’t Rush to Buy New

A brand-new car loses 10–20% of its value the moment you drive it off the lot. Consider:

Certified Pre-Owned (CPO) vehicles: Factory-inspected, low-mileage, and come with warranty

Reliable Used Cars (less than 5 years old): Honda, Toyota, Hyundai, and Mazda offer great value

Goal: Find a car under $25,000 with low mileage and good fuel economy.

💰 Step 2: Budget for More Than the Sticker Price

Many new immigrants underestimate the real cost of owning a car. Here’s what to include:

Down payment (if financing)

Taxes (13% HST in Ontario)

Insurance (higher if you're a new driver or lack Canadian history)

Registration & Licensing fees

Gas, winter tires, oil changes, maintenance

Pro Tip: Avoid high-interest loans — build your credit first or consider financing through your bank or credit union.

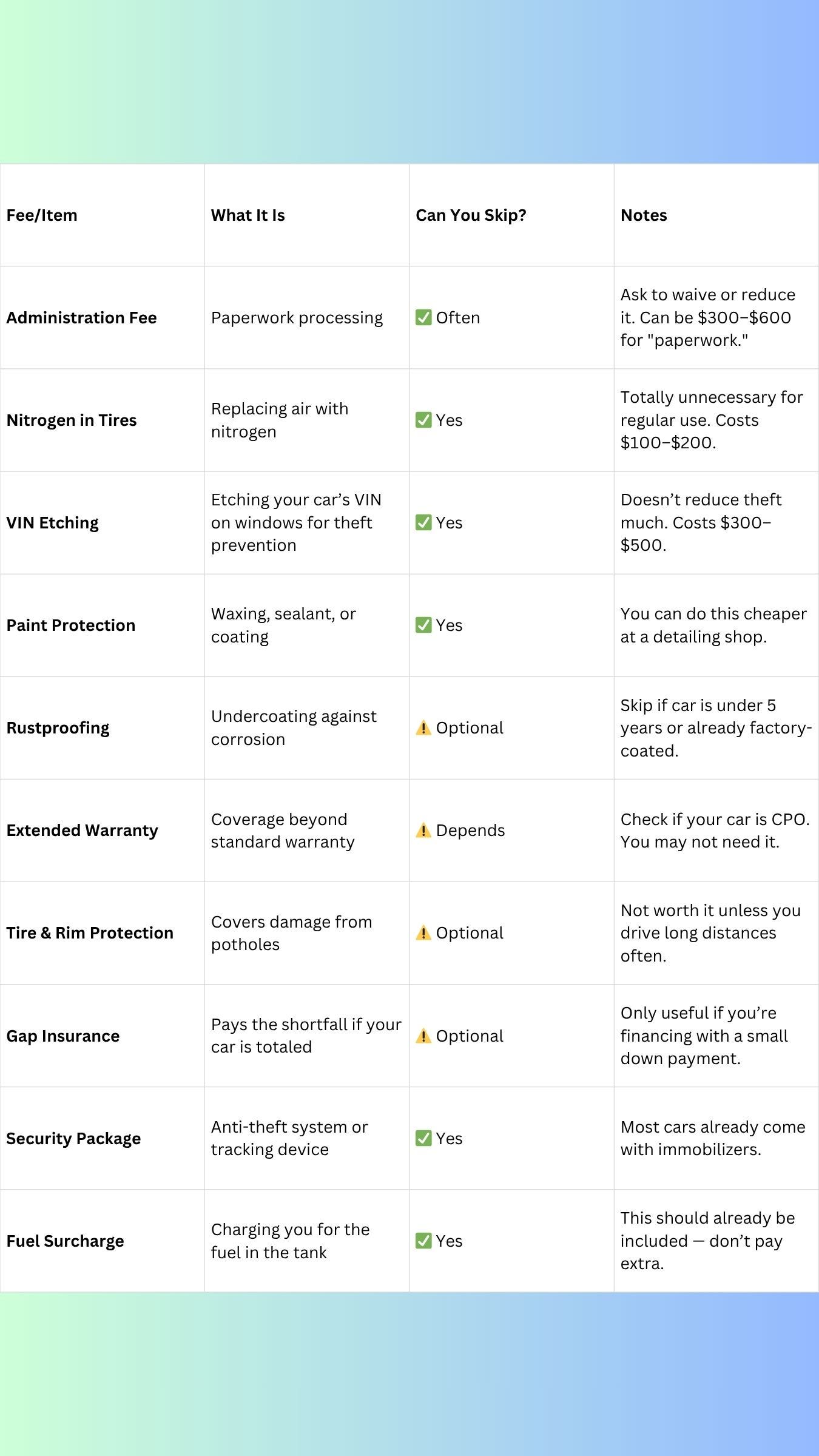

🧾 Step 3: Read the Bill of Sale Carefully — And Know What to SKIP

Here are typical dealer extras that you can politely decline or negotiate:

💳 Step 4: Financing Tips for Newcomers

Even with no credit history, you can finance — but shop around:

✅ Do This:

Try Immigrant-focused programs (Scotiabank StartRight, RBC newcomers auto loan)

Bring employment letter, PR card/Work Permit, proof of income, Canadian driver’s license

Offer a larger down payment to reduce interest

❌ Avoid This:

High-interest “subprime” car loans (common at shady used car lots)

Balloon payments or “zero down” tricks

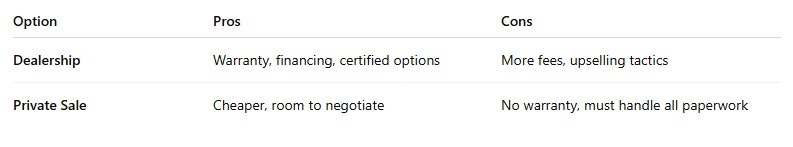

📍 Step 5: Where to Buy — Dealer vs. Private Sale

If going private, always:

Use Carfax to check accident history

Verify ownership and Used Vehicle Information Package (UVIP)

Bring a mechanic for inspection

🔐 Step 6: Don’t Forget Insurance!

New immigrants often pay higher rates. Reduce your premiums by:

Taking a certified driving course in Canada

Choosing a higher deductible

Bundling with home or tenant insurance

Getting quotes from multiple brokers (think: Surex, Sonnet, or traditional brokers)

🧠 Final Tips to Save Money as a New Immigrant Car Buyer

✅ Do your homework — never rely on the salesperson's word alone.

✅ Negotiate everything, especially fees.

✅ Skip emotional buying — don’t fall in love with the first car.

✅ Ask for promotions, seasonal discounts, or cashback offers.

✅ Use settlement programs — some offer transportation credits or rebates.

📦 Summary Checklist for Smart Car Buying

Decide on New vs. Used (CPO Preferred)

Budget realistically: include tax, insurance, and fuel

Decline unnecessary add-ons (see list above)

Compare insurance quotes

Consider financing options for newcomers

Ask questions and don’t be rushed

Always test drive before buying

Remember: The goal isn’t just to buy a car — it’s to own it smartly. As a newcomer in Canada, a little preparation can save you hundreds or even thousands of dollars on your first big purchase.

If considering buying your first car in Canada, read my well detailed out EBook: The Complete Uber Tax Guide for Canadian Drivers: Master Finance, Leasing, & Tax Deductions Like a Pro!: Drive Smart. File Smarter